EKG LINE: 🔍WHO'S WINNING THE PROMO RACE IN U.S. OSB?

A weekly newsletter with gambling industry insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

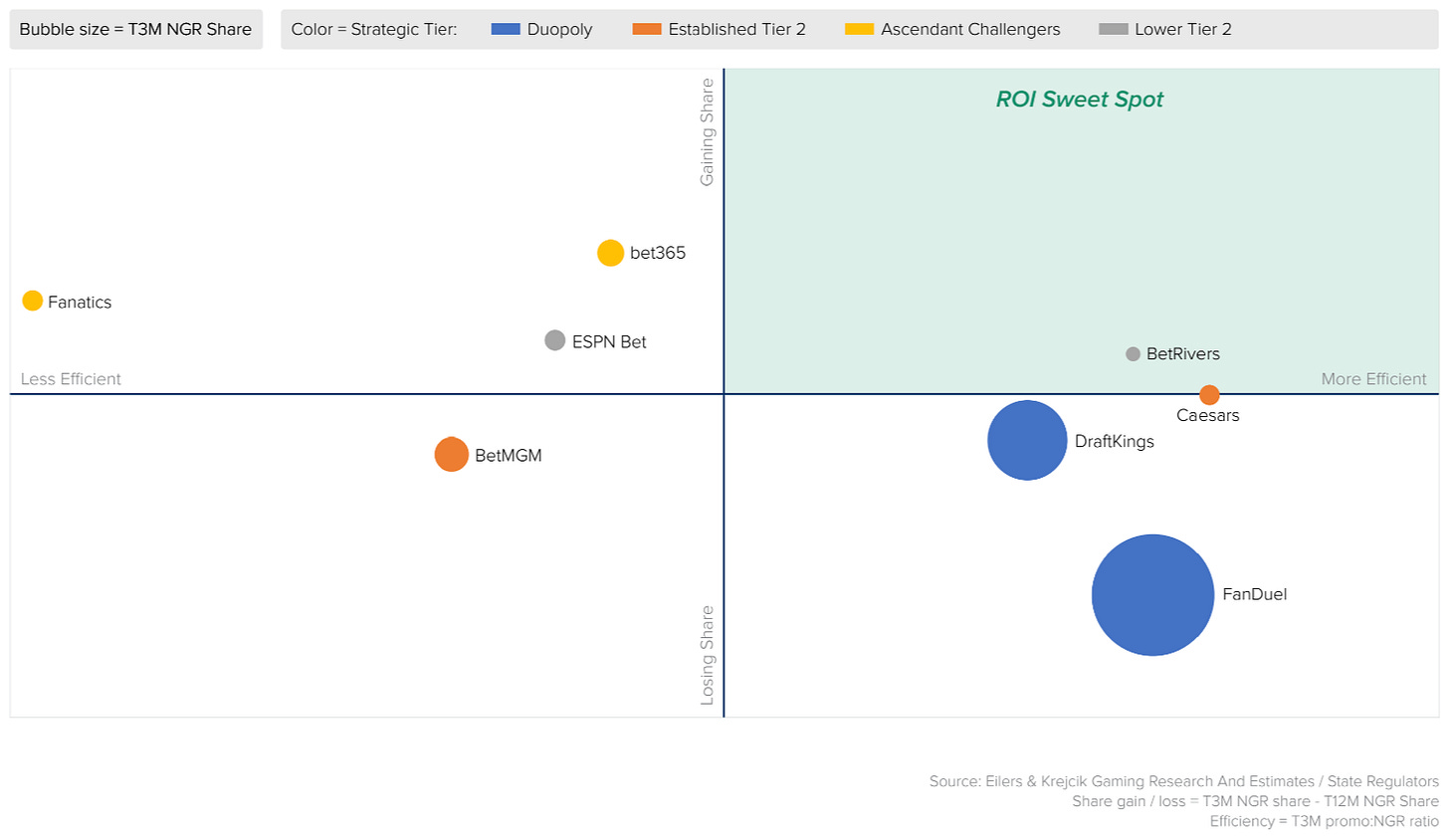

ONLY ONE OPERATOR LANDED IN THE MARKETING ROI SWEET SPOT

Our newly redesigned U.S. Sports Betting Market Monitor brings sharper clarity to operator performance—including who's making promo dollars count.

In the three months through May 2025:

BetRivers stood alone in our "ROI Sweet Spot”—shown above—gaining NGR share efficiently.

DraftKings and FanDuel remained lean-ish but ceded share, albeit from a high base.

ESPN Bet, Fanatics, and bet365 bought growth at higher cost—while BetMGM spent big and lost ground.

This is the kind of insight the SMM delivers each month—available to subscribers across all tiers.

➡️ See more from the updated SMM.

2. TRENDING UP / TRENDING DOWN

Trending up: OSB hold. With most states having reported May data, U.S. OSB net hold in 2Q25 is 7.4%—up more than 200bps vs. 1Q25 and 4Q24 when NFL and March Madness results went against the books.

Trending down: DFS in CA. DFS firms are fighting for the right to operate in CA, with Underdog this week suing to stop CA state AG Rob Bonta from releasing his opinion on the legality of DFS. The opinion is expected to ban DFS in CA—a state Underdog said accounts for ~10% of its revenue.

CHART OF THE WEEK: CAUTION ON A BETMGM TURNAROUND?

Shares of both BetMGM parents surged in mid June after the JV announced upgraded guidance—adding ~$150mm to NGR (now $2.6bn) and projecting ~$100mm in EBITDA.

Entain jumped 15% on the day; MGM rose 8%.

But state data tells a more tempered story. As the chart at above shows, the upgrade looks more like steadying the ship than a fundamental shift.

Indeed, OSB GGR share still hovers around 7%, and the product continues to underperform top-tier competitors, per our testing.

Still, the long-term upside case remains intact. If BetMGM can address its well-documented speed issues—as it has pledged—it has room to grow from current share levels, in our view.