EKG LINE: U.S. ONLINE CASINO KEEPS BOOMING

A weekly newsletter with gambling industry insider insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

Advertise your brand here. Contact Brad Allen for more details

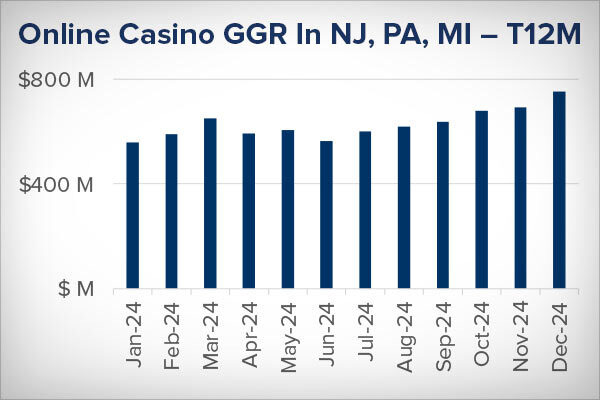

1. CHART OF THE WEEK: U.S. ONLINE CASINO KEEPS BOOMING

December 2024 saw U.S. online casino GGR touch an all-time high of $845.2mm, marking a third consecutive month of record results for the market.

What’s driving this record surge?

Channel checks indicated part of the December leap was probably attributable to OSB players—who had an unusually lucky 4Q24—recycling winnings.

As one example, our December data shows a sizable GGR share shift between game categories with Table Games (traditionally more popular with sports bettors) moving up to 13.4% of total, up from 9.8% in November.

BetMGM CEO Adam Greenblatt said Tuesday the company had seen some “emotional” recycling in December and January—that is, customers who had a good experience from winning wagers on the site and were thus more likely to come back and play again.

We also see an improving product-scape (our 2H24 casino app testing report will be published in February), with more jackpots, game titles and app upgrades like Penn’s new standalone Hollywood Casino app.

Elsewhere, we believe FanDuel is having success directly acquiring female players, and there’s likely at least some cross-sell/channel shift from land-based properties.

Bottom line: We expect strong online casino GGR growth to continue into 2025 and will have more to come on the drivers of that success.

2. PODCAST: TIME FOR M&A IN SPORTS DATA?

Host Brad Allen is joined by Matt Stephenson, global partnerships director at Genius Sports, to discuss:

Expectations for Super Bowl live betting

Genius's recent round of NFL data renewals with operators

Why consolidation among data providers makes sense

Listen to the episode here.

3. TRENDING UP / TRENDING DOWN

Trending up: Super Bowl live betting. In a flash note last week we estimated 15-20% of Super Bowl handle would come from live betting. That’s up around 5% on last year but still below typical NFL live betting levels of ~30%, thanks in part to the more recreational nature of Super Bowl bettors.

Trending down: Robinhood’s plans to enter the U.S. sports event contract trading space. Robinhood has paused its rollout of sports betting contracts following a request from the CFTC. The brokerage had previously said it planned to integrate Kalshi-powered sports markets into its platform.

4. CAN VIPS CONTINUE BETMGM REVIVAL?

The chart above shows our estimate of BetMGM’s U.S. online gambling GGR market share (OSB + online casino) since 1Q22—including a mini revival in 2H24, after a period of decline.

The company said Tuesday it had “stabilized share in the back half of 2024 and “cemented its podium position in the market.” 2H24 net revenue climbed 19%, compared to 6% growth in 1H, the company reported.

Going forward, CEO Adam Greenblatt, said BetMGM was moving to its “rightful place as the home for premium higher value players.”

Greenblatt explained: “We do not expect to acquire players at the same rate as we have in the past, but we do expect the average value of each of our players to be of a higher quality than before.”

Our take: Its a logical pivot given the MGM brand and access to the MGM retail properties as a reward scheme for high-value players. However, it does come with some drawbacks, including lower OSB hold than more recreational operators (VIPs are more likely to bet high-stake singles than SGPs), more hold volatility month-to-month, and potentially more risk if regulators start enforcing stricter RG protocols.