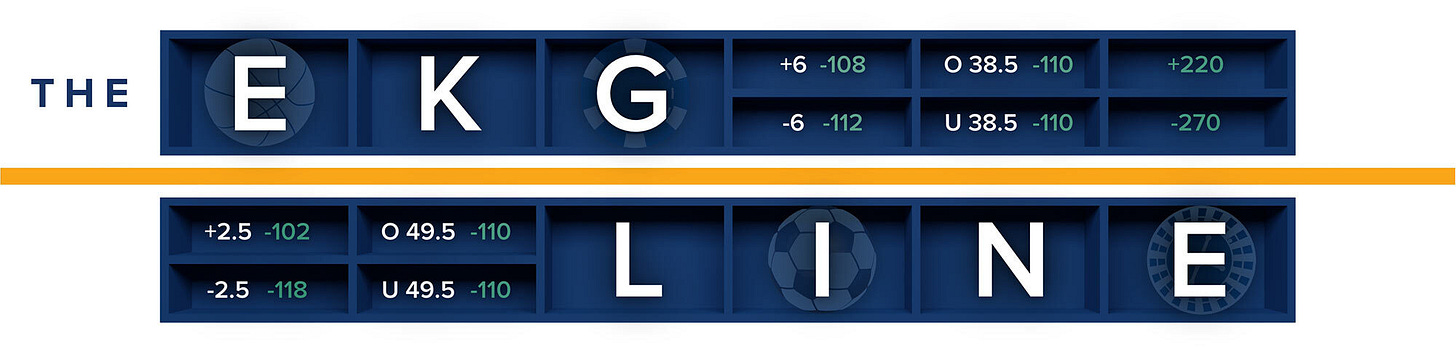

EKG LINE: TAX HITS KEEP ON COMING

A weekly newsletter with gambling industry insider insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

CHART OF THE WEEK: OHIO WEIGHS ANOTHER TAX HIKE

The chart above shows how operators would be affected by Ohio’s proposed SB 199, which would add a 2% handle tax to the existing 20% GGR tax.

The new tax would support publicly owned professional sports facilities and interscholastic athletics for Ohio K-12 students.

In the chart above, we model what the total tax burden would have been forOhio’s 5 largest operators if this proposal was effective over the last 12 months by converting the 2% handle tax to a GGR equivalent, then stacking it on top of the current tax.

The chart illustrates how extreme this proposal is—many operators would see their total state tax burden rise from 20% GGR to 40-50%—with operators with lower hold hit the hardest.

However, we are skeptical this will be implemented, given that House lawmakers were unwilling to move forward with Governor DeWine’s requested tax rate increase (40% GGR) which would have yielded a similar total tax burden.

2. PODCAST: CAN BETMGM FIX ITS SPEED ISSUES?

Host Brad Allen is joined by EKG's product testing team Jimmy Neilly and Danny McCarthy to discuss their latest app rankings, including:

Why bet365 has the best SGP product

Whether BetMGM can fix its speed issues

Why Fanatics can crack the top tier duopoly

Listen to the episode here.

3. TRENDING UP / TRENDING DOWN

Trending up: Horserace betting. Following news of record handle on the Kentucky Derby, Caesars announced it had integrated its parimutuel horse racing, powered by NYRA Bets, into its sportsbook app in Kentucky, Colorado, New York, Ohio, and Maryland, with more to come.

Trending down: Catena Media. Catena Media announced it cut 25% of its workforce last week in a push to reduce costs following a 40% drop in revenue in 1Q25. The affiliate, which operates U.S. sites including Legal Sports Report, is now valued at $14mm.

4. SPORTS EVENTS CONTRACTS TAKE CENTER STAGE ON EARNINGS CALLS

On 1Q25 earnings calls, OSB operators generally characterized the current sports event contract as not a major threat to the current OSB product, which is consistent with our internal analysis.

Flutter CEO Peter Jackson cited the popularity of parlays and other sophisticated betting products (e.g., player props, micro bets, price boosts) as strong evidence of differentiation from events contracts.

Leadership at Flutter and Penn noted that the largest opportunity for sports event contracts is in pending legal OSB states, where getting early access to large pools of prospective OSB customers could be a nice leg up.

DraftKings CEO Jason Robins said the contracts could also be an opportunity to help encourage OSB legislation in new states.

There are risks and rewards however. As we have previously discussed, deploying sports event contracts in California risks further lengthening its OSB legalization timeline by straining relations with powerful tribal stakeholders.

Indeed, panelists on The New Normal, a podcast specializing in tribal

gaming, recently characterized sports event contracts as an “existential threat” to tribal gaming, and opposing its legality as “a fight we must win."

We’ll have more on how OSB operators should tackle events contracts in our upcoming Sports Market Monitor for clients next week.