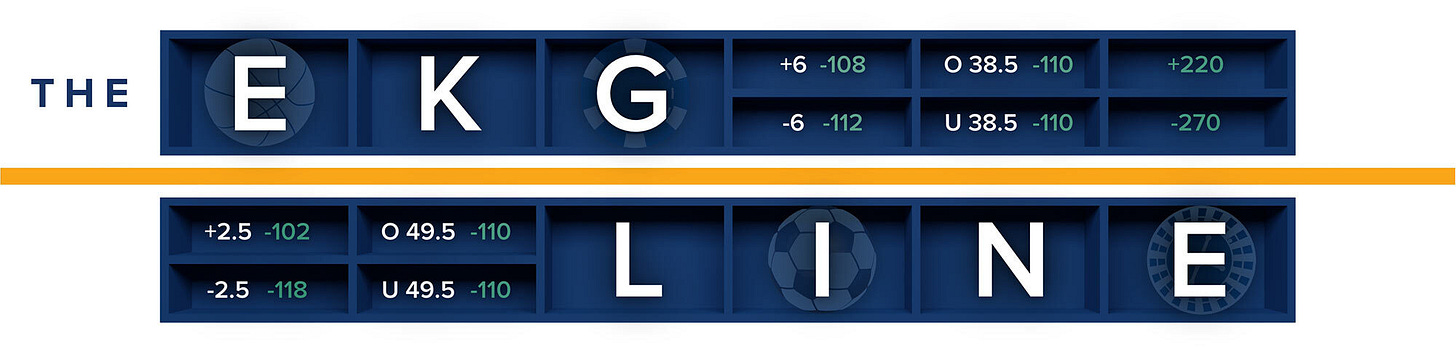

EKG LINE: FLUTTER AND BET365 HOOVER UP U.K. MARKET SHARE

A weekly newsletter with gambling industry insider insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

CHART OF THE WEEK: FLUTTER AND BET365 ARE TAKING SHARE OF THE U.K. MARKET

The chart above, taken from our new U.K. market coverage, shows online operator growth for the U.K. in CY24.

Key takeaways:

The GC Data column reflects all operators in the U.K. Gambling Commission data set.

Flutter and bet365 captured almost all the growth in the top end of the market during CY24 by our estimates, with Evoke and Entain largely market share

donors in the period.

This trend was significantly more apparent in 1H24 than 2H24 and we would not expect it to continue with this level of disparity into 1H25.

Bet365 has demonstrated a renewed focus on the U.K. market, with some changes in product and marketing leading to good growth over the past 12-18 months.

We think this growth is likely to slow down in the face of more meaningful competition from the likes of Entain.

We note bet365 data is not publicly available and we attach a low-confidence rating to our estimates here.

Flutter’s UKI growth was strong in both gaming and sports, and while sports was largely results-based, we believe it continued to take share from both Entain and Evoke in the period and was probably taking small share from the long tail.

2. PODCAST: WHO’S WINNING THE IN-PLAY TRADING GAME?

Host Brad Allen is joined by trading consultant Matthew Trenhaile to discuss:

Bet365's U.S. trading strategy

Whether Entain can maximize Angstrom

Why U.S. live markets are more dynamic than Europe

Listen to the episode here.

3. TRENDING UP / TRENDING DOWN

Trending up: Gaming stocks. Gaming stocks enjoyed a tariff-pause surge across the board this week, with double-digit gains for multiple firms including MGM, Caesars, and Penn Entertainment.

Trending down: Bally Casino product. Ballys finished in 12th position in our 2H24 online casino app testing, down five sports on the previous rankings, and the biggest faller overall. The report noted Bally’s had “failed to evolve its product offering,” with a lack of game depth, limited features, and generic design.

4. NUMBER TO KNOW: WHAT IS HARD ROCK DIGITAL WORTH?

The above is our back of napkin valuation for Hard Rock Digital, after Playtech said the low-single digit stake it bought in 2023 increased in fair value from $83mm to $163mm: a 96% uptick.

At the time, we calculated the investment valued HRD at ~$4bn.

The bullish upgrade appears to assume FL online casino in the next couple of years. That’s in line with our own projections which estimate a go-live date in 4Q26.

We estimate a FL online casino market would generate $2.3bn in annual GGR by 2029, along with $1.3bn in sports betting revenue, for $3.6bn in combined FL online gambling GGR.

Florida alone would represent nearly 10% of U.S. online gambling GGR in 2029, per our forecasts