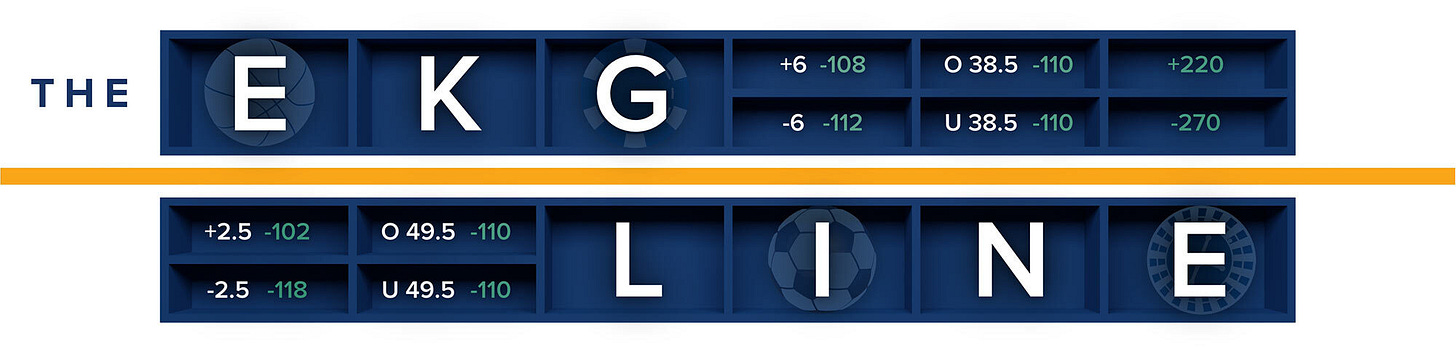

EKG LINE: FANATICS AND BET365 KEEP PICKING UP SHARE

A weekly newsletter with gambling industry insider insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

CHART OF THE WEEK: SPORTS-LED CHALLENGERS TAKE AIM AT CASINO STALWARTS

The chart above shows state-reported OSB NGR share for two loosely linked duos: Fanatics-bet365 and BetMGM-Caesars.

The Fanatics-bet365 pairing continued its NGR share climb in April, reaching a near high 6.0%.

Meanwhile, BetMGM-Caesars, despite a modest April rebound, remain on a longer-term decline path.

Fanatics and 365 are pairing competitive product with aggressive bonusing. Caesars has eased off promo spend; BetMGM has ramped it—but with inconsistent payoff.

The data now points to a potential Fanatics-365 overtake—an inflection that, in our view, underscores the momentum behind these ascendant challengers, and raises questions for BetMGM and Caesars about product parity and strategic identity.

2. PODCAST: ARE SPORTSBOOKS WRONG ABOUT THEIR STRUCTURAL HOLD?

Host Brad Allen is joined by Alun Bowden and former Fanatics trading SVP Andy Wright to discuss:

Recent analyst questions about sportsbooks missing hold expectations

Whether there are holes in SGP pricing

Why books might have a messaging problem

Listen to the episode here.

3. TRENDING UP / TRENDING DOWN

Trending up: Sweepstakes. Sweepstakes gaming brands in the U.S. are growing roughly three times faster than their real money counterparts, according to new Optimove data from more than 67,000 players across RMG and Sweepstakes platforms. Optimove said sweeps brands were growing their customer base around 16% month-on-month compared to 5% for RMG brands.

Trending down: CFTC headcount. The CFTC could be down to one commissioner instead of its usual five by July, following another announced departure this week. The remaining commissioner Caroline Pham is also set to be replaced by Trump nominee Brian Quintenz, who has historically been pro sports prediction markets.

4. THIS WEEK’S NUMBER TO KNOW: NBA HANDLE DIPS

That was the approximate decline in NBA betting handle for the 24/25 season versus the prior calendar year, per data from CO, IL, MD, NV, NJ and OR.

Revenue across the same period was up around 1% y/y, with multiple operators pointing out the soft NBA performance on recent earnings calls.

The handle decline was driven by macro and sport-specific trends. On a structural basis, handle has been low-growth thanks to to declining promo levels as well as the ongoing shift to higher margin, lower stake products like SGP.

For NBA specifically, FanDuel noted “less competitive matchups resulted in larger spreads” and therefore less betting appetite from customers.