EKG LINE: DRAFTKINGS EXTENDS OSB PRODUCT LEAD

A weekly newsletter with gambling industry insider insights from the Sports Betting & Emerging Verticals team at Eilers & Krejcik Gaming

DRAFTKINGS EXTENDS OSB PRODUCT LEAD

Last week we published our 1H25 OSB app rankings, with DraftKings topping the pile for the second report in a row.

Some highlights follow below, with the full report available to Enterprise subscribers or for purchase here.

Best app: DraftKings not only retained the top spot in our rankings but also slightly extended its lead over FanDuel. The app delivers an exceptional UX, deep markets, and a comprehensive feature set. The only real nitpicking from testers was occasionally glitchy live streaming and holes in cash-out availability.

Biggest surprise: Amid the brand’s growing momentum in online casino—where the Caesars Palace app has recently been gaining market share—Caesars Sportsbook has achieved its highest-ever rank in our OSB report, landing in 5th place. Its attractive, functional UX and intuitive Betting Interface—now with improved market depth—had long hovered just outside the top five and has finally broken through.

Most improved: Fanatics debuted in our 1H24 report in 6th place. In 2H24, it climbed to 3rd—but still trailed the top two by a significant margin. In this latest evaluation, it holds 3rd place again—but has closed the gap to within a fraction of a point, positioning Fanatics as a genuine contender for the top spot in future reports.

Most room for improvement: BetMGM has long struggled with speed, but beneath those issues lies a strong OSB app. Addressing load times and lag would significantly elevate the experience, as slow responsiveness often makes a meaningful impact on testers’ perception of the overall product. With better speed—and a slightly improved feature set—BetMGM could prove a force to be reckoned with.

2. PODCAST: HOW TO GROW YOUR ONLINE CASINO SHARE

Host Brad Allen is joined by former Resorts Digital CEO Ed Andrewes to discuss:

How smaller firms can gain online casino share

Why customer acquisition costs are coming down

How DraftKings has benefited from in-house content

Listen to the episode here.

3. TRENDING UP / TRENDING DOWN

Trending up: Penn online casino. Penn said online casino MAUs were up 20% y/y in 1Q25 thanks to the launch of the standalone Hollywood casino app, which ranks second among all U.S. casino apps, per our testing.

Trending down: DraftKings guidance. DraftKings lowered its 2025 guidance by $100mm at the midpoint to $800-$900mm, thanks to a poor run of sporting results in Q1, and a $26mm impact from Maryland increasing its tax rate on sports betting and Jackpocket shutting down digital lottery courier operations in Texas and New Mexico.

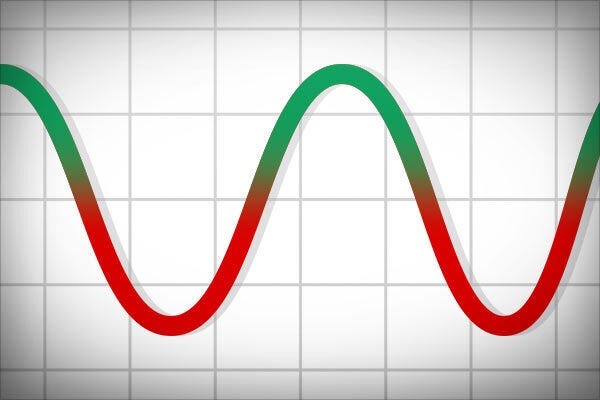

4. CHART OF THE WEEK: DO OUR PRODUCT RANKS PREDICT MARKET SHARE?

The chart above shows BetMGM’s OSB NGR share plotted against its ranking in our app testing, with a seeming loose correlation between the two.

While the trend looks concerning, the major issue for our product testers (see module 1) consistently been speed and BetMGM recently promised a major upgrade on in-app speeds.

If it has indeed fixed that one glaring weakness, BetMGM app scores and subsequent market shares could soon trend up.

We published similar charts and analysis for 8 leading operators—including FanDuel, DraftKings, and Fanatics—in a note for clients this week.